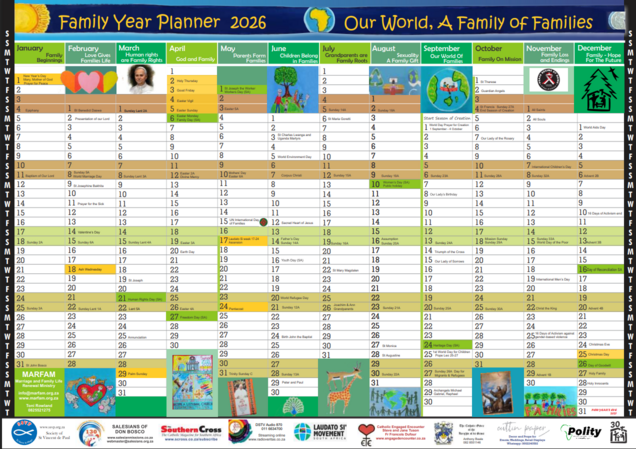

August 11. Taxes. On a very practical level the groups were discussing taxes. There is income tax, sales tax, e-tolls as road tax but there are also the different grants. “We give, but it is mostly others who get. Is that fair?” “I think the principle of the common good is a “good” one. For me it does put a positive spin on the fact that life isn’t fair.” “Don’t women on the whole carry heavier financial burdens as so many of our families are headed by single mothers?” “But what about young girls who they say get pregnant just so that they can get a child grant, which they don’t always even use for the baby?” “Shouldn’t all that be balanced out for the common good?” “I think we need to look more holistically at family units rather than at men’s or women’s perspectives. What about family income tax and family grants?”

Scripture: “The collectors of the half-shekel tax went up to Peter and said, “Does not your teacher pay the tax?” Matthew 17:22-27. Pope Francis. Families have the right to be able to count on an adequate family policy on the part of public authorities in the juridical, economic, social and fiscal domains. Families and homes go together. This makes us see how important it is to insist on the rights of the family and not only those of individuals. AL 44. JUBILEE: Consequently, the Christian community should be at the forefront in pointing out the need for a social covenant to support and foster hope, one that is inclusive and not ideological, working for a future filled with the laughter of babies and children, in order to fill the empty cradles in so many parts of our world. SNC9 Act and pray. For the needs of families of all kinds to grow in love and acceptance.

Recent Comments